Rate this article and enter to win

Want to buy a car? Lease an apartment? Get a mortgage for a house one day? You’ve probably heard this before, but in order to take out a loan for any big purchase, you’ll need to have a good credit score attached to your name. We touched on this in our piece on understanding credit, but if you’re still confused, let’s elaborate some more.

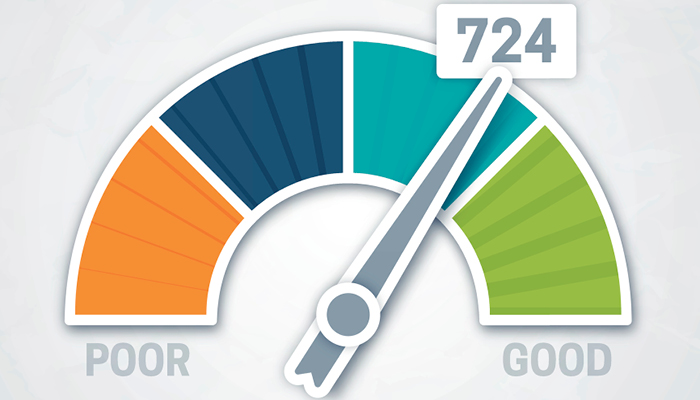

Put simply, a credit score is a number between 300 and 850 that’s created based on your spending habits. A high score (anything over 700) shows banks and lenders that you’re responsible with money and they can therefore trust you with a loan. Thus, the higher the score, the better your credit.

A low score tells banks they might not be able to trust you with a loan, since you might not be the best at managing money. And that means it might be harder for you to take out a loan or you might get hit with a higher interest rate (the fee the lending company charges you for allowing you to borrow the money) on loans and credit cards.

So, let’s review:

Good credit = Save money, get approved for loans, buy all the things.

Bad credit = Potential for more debt, struggle to get a loan, live in your parents’ basement the rest of your life.*

*We’re totally kidding. But it could happen.

In all seriousness, even if you do have a low credit score (e.g., you opened a credit card and missed a few payments), don’t fret: It isn’t permanent. You can still work to get it higher by developing healthy credit habits. Chances are you’re just starting to build your score—which is great.

“Starting to build credit history at a young age will add additional years to [your] length of credit history. The earlier [you start], the better,” says Kelly DiGonzini, senior financial planner at Beacon Pointe Advisors in California.

Achieving a good credit score isn’t as hard as you think. Keep these tips in mind for building up and up.

6 key tips for building your credit score

1. Always pay your bills on time.

“The key is to fully pay off your credit cards, on time, every month. That’s how you’ll build a great credit score,” says DiGonzini. Late payments or defaults (not paying at all) will have a negative impact on your credit score.

2. Keep your balance low and your available credit high.

That means trying to keep your balance to less than 30 percent of your available credit, if you can (there are no hard-and-fast rules, but this number seems to be the expert-recommended consensus). For example, if your credit card has $1,000 available, keep your balance under $300.

3. Establish a long history.

Avoid closing old credit card accounts (as long as they don’t charge an annual fee) even when you don’t use them anymore. You can just tuck that credit card away in a drawer so you’re not tempted by it. The longer you have accounts open, the more history you’ll have.

4. Avoid frequently opening new credit lines.

This affects the average time your accounts have been open (see point 3 above). Plus, every time you apply for new credit, it negatively affects your score and stays on your report for two years. This only makes up 10 percent of your score, so don’t worry about it too much, but avoid applying for every credit card or loan out there.

5. As time goes on, establish a credit mix.

Lenders like to see you use different types of credit, such as a credit card, student loan, and a home mortgage—it shows that you’re a responsible borrower. This can be difficult to do when you’re first starting out, so keep it in mind for the future; for now, just aim for responsible credit use.

6. Follow up before and after a missed payment.

If you’re finding it difficult to make your payment or you missed a payment, immediately contact the lender and discuss it with them. They may be willing to work with you to come up with a repayment plan, and this can limit the damage to your score. The process is pretty straightforward, so don’t let it stress you out.

Students share their tips on building credit

“Once you own a credit card, use it for small purchases and pay it in full every month. Late payments affect your credit score, so it’s crucial that you pay on time.”

—Eyob A., recent graduate, University of Maryland, Baltimore County

“I got a checking and savings account along with a credit card from my bank. Use the credit card to build credit, but be wary of getting into debt. They increased my spending limit to $1,600, and I’m in the hole for almost the entire amount.”

—Alejandra M., first-year undergraduate, Metropolitan State University, Minnesota

“Budget everything and never spend more money than you have. Building credit takes time, but if you’re proactive about paying off your bills and never overspending, then building credit will be easy.”

—Tabitha T., third-year undergraduate, South Dakota State University

“Don’t get a credit card until you know that you can manage one and pay for it. It’s difficult to build up your credit score and it takes time, but you can very easily ruin your credit by not making payments, having too much debt, opening too many credit cards at once, you name it.”

—Amanda L., first-year graduate student, Wake Technical Community College, North Carolina

“You could take out a small loan of just a few hundred dollars just to build credit, and pay that off in just a few short months to minimize paying interest. Having various forms of credit and experience paying those off positively impacts your credit score over time.”

—Jonathan C., fifth-year undergraduate, Park University, Missouri

“No credit essentially is bad credit. Credit is something you want to develop from a young-ish age (like late teens or early- to mid-twenties). Don’t wait too long until you’re trying to make huge purchases, like a house.”

—Elliece R., third-year undergraduate, University of Regina, Saskatchewan, Canada

Credit card basics: Federal Trade Commission

What is a secured credit card?: NerdWallet

Lost or stolen cards: Federal Trade Commission

Protecting against credit card fraud: Federal Trade Commission

Financial literacy quiz: Georgia State University

Set yourself up for financial success: Harvard College Griffin Financial Aid Office

Article sources

Kelly DiGonzini, CFP, MST, senior financial planner at Beacon Pointe Advisors, Newport Beach, California.

Askew, A., Goering, M., Rysdahl, I., Smith, C. et al. (2013). Financial literacy and perceptions of post-college life of undergraduates. St. Olaf College. Retrieved from https://wp.stolaf.edu/sociology/files/2013/06/Fianancial-Literacy-and-Perceptions-of-Post-College-Life-of-Undergraduates.pdf

Detweiler, G. (2016, December 8). Just how bad is my credit score? Credit.com. Retrieved from https://www.credit.com/credit-scores/what-is-a-bad-credit-score/

Dornhelm, E. (n.d.). US average FICO score hits 700: A milestone for consumers. FICO Blog. Retrieved from https://www.fico.com/en/blogs/risk-compliance/us-average-fico-score-hits-700-a-milestone-for-consumers/

Federal Trade Commission. (2013, September). Credit scores. Retrieved from https://www.consumer.ftc.gov/articles/0152-credit-scores

Federal Trade Commission. (2013, March). Free credit reports. Retrieved from https://www.consumer.ftc.gov/articles/0155-free-credit-reports

Federal Trade Commission. (2012, August). Setting out on your own. Retrieved from https://www.consumer.ftc.gov/articles/0331-setting-out-your-own

Harvard College Griffin Financial Aid Office. (n.d.). Set yourself up for financial success. Retrieved from https://college.harvard.edu/financial-aid/financial-literacy/credit

Raghaven, D. (2014, July 7). How student loans affect your credit score. US News & World Report. Retrieved from https://creditcards.usnews.com/how-student-loans-affect-your-credit-score

Singletary, M. (2017, July 11). Average FICO score crosses a milestone, but let’s not get cocky. Washington Post. Retrieved from https://www.washingtonpost.com/business/get-there/average-fico-score-crosses-a-milestone-but-lets-not-get-cocky/2017/07/11/ac288f6a-6650-11e7-8eb5-cbccc2e7bfbf_story.html?utm_term=.1ae7f5948440

USA.gov. (2017, May 11). Credit reports and scores. Retrieved from https://www.usa.gov/credit-reports

US Department of Education. (n.d.). Interest rates and fees. Federal Student Aid. Retrieved from https://studentaid.ed.gov/sa/types/loans/interest-rates